Singapore

Atrium Legal Lab will assist you

Setting up your PSP company in Singapore and

Applying for a Financial License

So that you may Legally act as a Payment Services Provider

Cryptocurrency

Licensing Services

- BVI Cryptocurrency Licensing and Regulations

- Canada MSB Crypto License

- Czech Republic – Crypto License

- Ireland

Cryptocurrency

Company - Isle of Man Cryptocurrency

Exchange & Trade - Lithuania

Crypto Exchange & Wallet License - Cyprus Brokerage Services

Forex Trading License - Labuan Money Broker License (Forex)

- Mauritius Investment Dealer

& Broker License - Seychelles Securities Dealers License, Forex

- Vanuatu Securities Dealers

Licenses - ForexE-Money

Payment Services

Institutions (EMI - PSP)- Canada MSB

Alternative to EU EMI license- Ireland

A Location for E-Money and Payment Institutions

Ireland EMI License- Mauritius

Payment Intermediary Services

Online Payment Services Provider (PSP)- New Zealand FSP

Financial Services Providers- Singapore

One of the World’s Prime Location for

E-Money and Payment InstitutionsInvestment Funds

- BVI Hedge Funds

- Panama PIF20 – PIF50

Private Placement Funds in Panama- UK PFLP

Private Fund Limited PartnershipsAsset Management

Company- Luxembourg - Private Asset

Management Company (SPF)- Luxembourg SOPARFI

Holding & Finance Company - Vanuatu Securities Dealers

Foreign Exchange (FX)

Securities Dealer

License

PSP – Payment Service Providers

MAS – Monetary Authority of Singapore

MAS - Monetary Authority of Singapore

Singapore's Payment Services Act

Types of Payment Services

Types of Licenses

Ongoing Requirements

The specific Payment Services

Application for a Payment Service Provider License

Questions and Answers

Technology is transforming Singapore’s payments landscape; it has lowered the barriers to entry to running a payments business.

This, coupled with the high penetration of smart phones, has made it easier to acquire

customers digitally.

Singapore is ranked as one of the world’s leading financial centers. It offers world-class options in banking and related financial services for corporate clients. One of the fastest growth areas within the country’s financial sector is modern payment services and the infrastructure to support them.

The country is experiencing fast innovation in this segment with many well-funded startups having been launched in Singapore. The Singapore Government has kept abreast with these innovations and new technology developments by revising its regulatory framework as and when needed. The most recent development in this vein is the adoption of the Payment Services Act 2019 (“the PS Act”).

The PS Act came into force on January 28, 2020. Previously, regulation of payment services was governed by the Payment Systems (Oversight) Act (“the PS(O)A”) and the Money-changing and Remittance Businesses Act (“the MCRBA”). The regulations from these two older Acts were modified and merged into the PS Act, and these Acts are now repealed.

The new law has two main objectives: the first is to protect the financial stability of Singapore and ensure fair competition between market participants; the second is for MAS to establish a licensing regime and provide direct oversight of payment systems and payment service providers to ensure that they comply with the Anti Money Laundering and Countering the Financing of Terrorism (“the AML and CFT”) regulations.

To comply with the PS Act, Singapore’s businesses who in any manner are involved with payment systems or payment services must be familiar with the licensing measures and obligations entailed in the AML and CFT regulations

A new framework to Financial Services innovation

The new regulations governing payment services in Singapore that came into force through the recently passed Payment Services Act.

The development of this new legislation was spearheaded by the Monetary Authority of Singapore (MAS) and it is designed to create a robust e-payments ecosystem in Singapore while ensuring consumer protections and building consumer confidence in the use of e-payments.

The Act adopts a licensing framework for various payment services activities and acknowledges new innovations and technology developments in the field payment services. It also expands the Monetary Authority’s regulatory domain to include new types of payment services such as digital payment token services.

Payment service providers and payment systems are both regulated under the Payment Services Act 2019 ("PS Act").

Payment Service Providers are licensed to provide specified payment services under the PS Act. Payment systems facilitate the transfer of funds between or among participants and may be designated under the PS Act for closer supervision.

Types of Payment Services

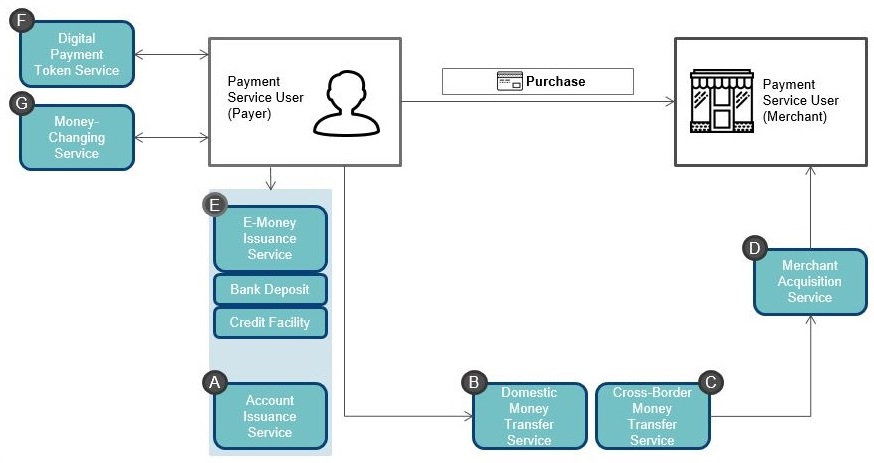

MAS regulates seven payment services under the PS Act:

| Activity Type Activity A Account issuance service |

Brief Description The service of issuing a payment account or any service relating to any operation required for operating a payment account, such as an e-wallet (including certain multi-purpose stored value cards) or a non-bank issued credit card. |

| Activity B Domestic money transfer service |

Providing local funds transfer service in Singapore. This includes payment gateway services and payment kiosk services. |

| Activity CCross-border money transfer service |

Providing inbound or outbound remittance service in Singapore. |

| Activity DMerchant acquisition service | Providing merchant acquisition service in Singapore where the service provider processes payment transactions from the merchant and processes payment receipts on behalf of the merchant. Usually the service includes providing a point-of-sale terminal or online payment gateway. |

| Activity EE-money issuance service |

Issuing e-money to allow the user to pay merchants or transfer to another individual. |

| Activity FDigital payment token service |

Buying or selling digital payment tokens (“DPTs”) (commonly known as cryptocurrencies) or providing a platform to allow persons to exchange DPTs. |

| Activity GMoney-changing service |

Buying or selling foreign currency notes. |

There are exclusions from the scope of payment services under Part 2 of the First Schedule of the PS Act , such as services by technical service providers that do not accept money, and services in respect of limited purpose e-money.

The diagram below shows how the payment services interact with each other, merchants and consumers.

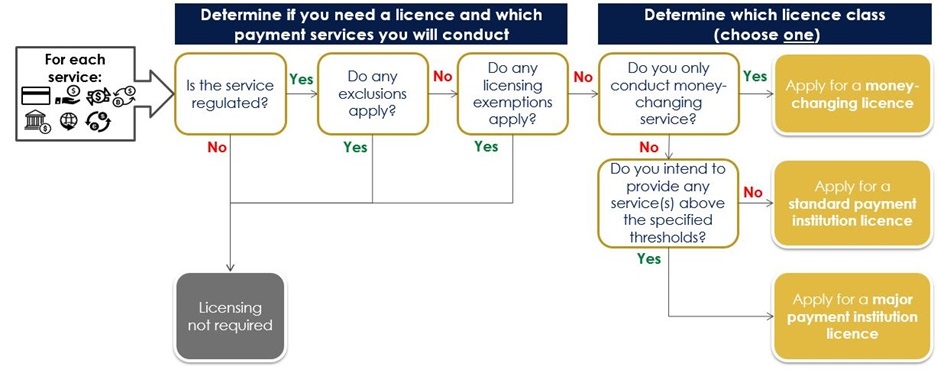

Payment Service Providers can conduct multiple payment services under one license. There are three types of licenses that Payment Service Providers can hold to provide the payment services above:

Money-Changing License

Money-Changing licensees are only able to conduct money-changing services. Find out about their licensing requirements.

Standard Payment Institution License

Standard Payment Institutions are able to conduct multiple payment services below specified thresholds. Find out about their licensing requirements.

Major Payment Institution License

Major Payment Institutions are able to conduct multiple payment services without any limits on transaction volume or float. Find out about their licensing requirements.

Licensees are required to comply, on an ongoing basis, with all applicable requirements set out under the PS Act, as well as other relevant legislation.

Licensees are expected to put in place systems, policies and procedures to ensure that they fulfil all ongoing obligations, including the key areas below:

Anti-Money Laundering and Countering the Financing of Terrorism

Requirements

Periodic Returns

Cyber Hygiene

Business Conduct

Disclosures and Communications

Annual Audit Requirements

Licensees should also understand and apply the relevant MAS Guidelines and keep abreast of regulatory changes.

| Payment Service | Specific Payment Service | Specified Period |

| Account issuance Service | Providing account issuance service | 12 months from commencement i.e. 28 January 2021 |

| Domestic money transfer service | Providing domestic money transfer service | |

| Merchant acquisition service | Providing merchant acquisition service | |

| E-money issuance service | Issuing e-money where the total float (set out in the PS Act as total relevant money) held by the e-money issuer does not exceed S$30 million | |

| Digital payment token service | Providing digital payment token | 6 months from commencement i.e. 28 July 2020 |

If you wish to provide payment services under the Payment Services Act ("PS Act"), you must hold a payment service provider license.

You may refer to the decision tree below to assist you in considering whether you are conducting a payment service and which license would be suitable for you.

If you are unsure of who to approach, you may consider participating in the Payments Regulatory Evaluation Programme (“PREP”). This is not mandatory, and MAS does not endorse any of the service providers under PREP.

Questions and Answers

What are some of the questions that will be asked during the application interview for license application with Monetary Authority of Singapore (MAS) as regulated via the Payment Services Act (PSA)?

MAS will access the key individual’s understanding of the Payment Services Act (PSA) and requirements in relation to their business model. They will also discuss the compliance and audit arrangements. Audit here refers to internal audit.

Apart from the admission requirements, MAS will also ask applicants on how you intend to comply with the ongoing requirements.

Depending on how comprehensive the information provided is, there may be more than one round of interview. Essentially, the more complete your application is, the fewer rounds there will be.

Can the permanent place of business/registered office be finalised only when business commences for Payment Services License (PSL) holders?

The Monetary Authority of Singapore (MAS) understands that there are factors such as rental costs etc. involved so this can be finalised after receiving the In-Principle Approval (“IPA”). However, this must be done prior to license issuance.

As a reminder, permanent place of business/registered office must be an office area where the applicant’s books and records can be securely held. Co-working spaces with hot-desking arrangements do not meet this requirement.

Must base capital requirements be met at the point of application for entities desirous to be regulated under the Payment Services Act (PSA)?

Base capital requirements should be met at the point of license application. However, if the applicant has legitimate reasons why the entity cannot meet the requirements and have plans to raise capital (e.g. via fund raising), this needs to be elaborated on in the application.

The Monetary Authority of Singapore (MAS) will not grant a license if the base capital requirements cannot be met. Any plans to raise funds need to be concrete and ideally already in motion. For instance, if the company intends to raise funds, it should ideally have identified investors and have a realistic short-term timeline (within 1-2 months) to complete the fund raising.

What happens to rejected Payment Services License (PSL) applications?

In a nutshell, if you have not started operations, you will not be able to start. If you have started operations but not carrying out a regulated activity, you may continue as per usual if you do not require a license. However, you will not be able to carry out any regulated activities if your application is rejected. For those who are operating under the exemption period, if your application gets rejected, you will have to stop business immediately upon rejection of the application.

Applicants can apply as many times as you want but it is advisable to only do so when you have re-assessed that you are ready to apply again. Trying a second time without improving your business plan or your mitigating controls will not change the end result. Essentially, you do not want too many rejections under your records as it does not reflect well for your entity.

Our lawyers and financial services specialists at Atrium Legal Lab provide solutions to clients by combining the traditional legal fabric with new technologies.

Singapore is undoubtedly and excellent international option, offering you extremely low tax advantages.

Atrium Legal Lab has a team of trained professionals to advise clients who wish to become a licensed Payment Service Provider.

In particular, we welcome questions about the PSP Registration in Singapore and are pleased to fully assist you.

Licensing Services

Our Company Services

Services we DO and Services we DO NOT DO

Our company is EXCLUSIVELY engaged in assisting worldwide clients, either individuals or corporate entities, to get duly and properly registered and licensed with local Regulators and Financial Authorities to get respective official licenses to legally carry out their cryptocurrency business activities.

Atrium Legal Lab does not carry out any sort of cryptocurrency business trade or financial service!

You would like to discuss with us

You can either call or email us.

One of our Customer Representatives will be most pleased to help and assist you

The information and materials contained in this website do not constitute an offer, invitation, solicitation, advice or recommendation to buy the products and services offered and rendered by Atrium Legal Lab and shall be applied with prior consultation.

Atrium Legal Lab does not offer legal or tax advice without consultation with certified professionals with related appropriate skill and expertise.

The information contained in this website is for general guidance on matters of interest only and should not be considered as guidance for financial or tax decisions, or a substitute for specific professional consultation.

Atrium Legal Lab is not a bank, nor does it provide banking services. Atrium Legal Lab offers international company formation, corporate administration services, and bank/broker introductory services and account opening assistance.

This website is only used for promotional marketing purposes of Atrium Legal Lab and is not intended to portray that this is the site of a bank. All prospective clients should consult a properly qualified tax professional in their own country to determine their own tax implications prior to embarking on any strategy described in this website. Since laws in each country are different, constantly change and can be subject to different interpretations by courts of law, any information herein regarding tax minimization needs to be verified by such competent counsel. While we have made every effort to ensure that the information contained in this website is accurate and correct due to constant changes in laws, rules and regulations Atrium Legal Lab Ltd accepts no liability for any loss or damage arising directly or indirectly from action taken or not taken relying on the information contained in this website. In particular no warranty is given as to the completeness, accuracy, reliability of such information and as to whether it is at all times up to date.

Atrium Legal Lab accepts no liability for any loss or damage direct or indirectly arising from the application of any information contained in this website, including any loss, damage or expenses arising from, but not limited to, any defect, error, mistake, inaccuracy, reliability of this website, its contents or related services, or due to any unavailability of this Site or any part thereof of any contents or related services.

Due to our internal policies to prevent fraudulent activities or violations of our internal AML policies we are regretting that we do not provide consultations, email support, on-boarding activities and customer care to all OECD black listed countries and their citizens / entities.