We are most engaged to apply for and maintain business licenses

and to assist financial services firms with all their regulatory obligations!

Our Business Team has a proven track record, regulatory experience

and our purpose is to ensure that your compliance requirements

are managed with confidence!

Atrium Legal Lab

Your Global Financial Advisor

A Tax and Law Centre

to get your financial entity duly licensed

under a Regulated and Legal Environment

Tax Legal Advisors

registered as a Cryptocurrency

Trade and Exchange entity, or to

obtain an Authorised Payment or

Electronic Money Institution or

Foreign Exchange license, Atrium

Legal Lab offers its Legal,

Technical and Business Expertise

to help you start your

Fintech Business.

As cryptocurrencies spread across the globe, so too do the regulations put in place to try and govern them. The landscape constantly keeping up to date with the rules in different territories is not easy. Atrium Legal Lab will assist you in navigating the various legislative positions towards cryptocurrencies and the activities associated with them.

BVI

It has been recently introduced in BVI new innovative fintech regulations, reaffirming BVI as a jurisdiction of choice for new financial products and services, thus showing a development taken by the BVI to the new fintech area.

Canada

Canada is a highly regarded Crypto solution, with 2 major advantages: No capital requirement and an extremely fast licensing process. Canada Money Service Business (MSB) License allows you to deal with Virtual currency exchange and transfer services.

Czech Republic

If you wish to apply for a Crypto License, Czech Rep. will offer you excellent advantages:

Fast project implementation / No share capital required / No obligatory local staff member / Licenses recognized worldwide / Extremely Low Cost.

Ireland

Ireland is the perfect gateway to do business and trade Bitcoin in the European Union; Ireland hosts multiple global financial and information technology giants; Corporate taxation in Ireland is low at 12.5%.

Isle of Man

An excellent option for those in the business of issuing, transmitting, transferring, managing, lending, buying, selling, exchanging, trading or intermediating convertible virtual currencies, including crypto-currencies or similar concepts.

Lithuania

Lithuania is now becoming one of the most crypto-friendly and attractive jurisdictions within the EU. In comparison to Estonia, Lithuanian regulations can be viewed as more flexible and come at lower on-going cost as there is no specific requirement for onsite personnel.

Lithuania

Lithuania is now becoming one of the most crypto-friendly and attractive jurisdictions within the EU. In comparison to Estonia, Lithuanian regulations can be viewed as more flexible and come at lower on-going cost as there is no specific requirement for onsite personnel.

New Zealand

If your wish to set up your Crypto exchanges, wallets, deposits, and broking company in New Zealand, you need to simply register with FSPR under “operating a value transfer service’ and “issuing and managing means of payment”.

Securities Dealer License

Forex Market

Get duly and Properly Licensed

Before you start as a Forex Broker

Labuan

Money Broker

License (Forex)

Labuan welcome anyone who is interested to set up a 100% foreign owned Cryptocurrency Exchange, ICO, STO, Payment System (e-Wallet), Money broking (FOREX) and Digital Bank which can operate with tax as low as 3% on net audited profit.

Mauritius

Investment Dealer

& Broker License

Mauritius Investment Dealer Broker License allows you to execute orders for clients to manage portfolios of clients and to give advice on securities transactions to clients.

Seychelles

Securities Dealer

License

A Securities Dealer License is a broker License that allows a company to trade in securities either as a principal (on its own account) or as an agent (on behalf of its clients).

Vanuatu

Foreign Exchange

License

Increasingly Popular among Binary Options and FX Brokers Vanuatu Securities Dealers License allows you to buy, sell, trade securities such as shares, bonds, options etc. and manage a portfolio of investments for and on behalf of your clients.

If you are looking to issue electronic money,

to make payments related to e-money,

offer credit and debit card services or

online bank transfer while acting as a third party between banks and customers,

Atrium Legal Lab offers its legal,

technical and business expertise

to help you start your Fintech Business.

Canada

Money Service

Business (MSB)

You are an MSB if you are in business in Canada to offer any of the following services to the public:

Foreign exchange dealing, Money transferring, Issuing or redeeming money orders, traveler’s cheques or anything similar, and dealing in virtual currency; no capital requirement, no annual registration fees.

Ireland

Electronic Money

Institution

A license issued in Ireland is recognised in all EU and other EEA (European Economic Area) member states. Through ‘passporting’, this enables the electronic money institution to operate across all EEA countries with a single license.

Mauritius Online

Payment Services

Provider (PSP)

Mauritius Payment Intermediary Services allows you to offer wallets/accounts to individuals and corporate clients, enable funding wallets by incoming and outgoing payments, offer online banking and transfer options, issue debit cards by co-branding or white label, amongst others.

New Zealand

Financial Services

Provider

Registration

Besides no capital requirement New Zealand is recognized as a Premium Jurisdiction. It provides all the advantages of all traditional Financial Centres and it is recognized as a true Onshore Financial Centre which is not blacklisted by any authority in the world.

Singapore

Payment Services

Provider (PSP

License)

Technology is transforming Singapore’s payments landscape; it has lowered the barriers to entry to running a payments business. Singapore is ranked as one of the world’s leading financial centers. It offers world-class options in banking, cryptocurrency and related financial services for corporate clients.

Ireland

Electronic Money

Institution

A license issued in Ireland is recognised in all EU and other EEA (European Economic Area) member states. Through ‘passporting’, this enables the electronic money institution to operate across all EEA countries with a single license.

Lithuania

Electronic-Money

Institution License (EMI)

Lithuania became a hub for many well-known EMI’s due to transparent and cutting-edge legislation, ease of doing business and its location. Electronic money institutions can join the SEPA payment infrastructure and offer their customers personal accounts with IBAN codes.

Mauritius Online

Payment Services

Provider (PSP)

Mauritius Payment Intermediary Services allows you to offer wallets/accounts to individuals and corporate clients, enable funding wallets by incoming and outgoing payments, offer online banking and transfer options, issue debit cards by co-branding or white label, amongst others.

New Zealand

Financial Services

Provider

Registration

Besides no capital requirement New Zealand is recognized as a Premium Jurisdiction. It provides all the advantages of all traditional Financial Centres and it is recognized as a true Onshore Financial Centre which is not blacklisted by any authority in the world.

Singapore

Payment Services

Provider (PSP

License)

Technology is transforming Singapore’s payments landscape; it has lowered the barriers to entry to running a payments business. Singapore is ranked as one of the world’s leading financial centers. It offers world-class options in banking, cryptocurrency and related financial services for corporate clients.

Ireland

Electronic Money

Institution

A license issued in Ireland is recognised in all EU and other EEA (European Economic Area) member states. Through ‘passporting’, this enables the electronic money institution to operate across all EEA countries with a single license.

Mauritius Online

Payment Services

Provider (PSP)

Mauritius Payment Intermediary Services allows you to offer wallets/accounts to individuals and corporate clients, enable funding wallets by incoming and outgoing payments, offer online banking and transfer options, issue debit cards by co-branding or white label, amongst others.

New Zealand

Financial Services

Provider

Registration

Besides no capital requirement New Zealand is recognized as a Premium Jurisdiction. It provides all the advantages of all traditional Financial Centres and it is recognized as a true Onshore Financial Centre which is not blacklisted by any authority in the world.

Singapore

Payment Services

Provider (PSP

License)

Technology is transforming Singapore’s payments landscape; it has lowered the barriers to entry to running a payments business. Singapore is ranked as one of the world’s leading financial centers. It offers world-class options in banking, cryptocurrency and related financial services for corporate clients.

Private Asset Management

Luxembourg SPF

Private Asset

Management

Company

Family Wealth Management (SPF) The SPF is designed as an Investment Company for Purchasing, Holding, Managing and Selling of any kind of Financial Assets (excluding commercial activities).

Luxembourg

SOPARFI

Holding & Finance

Company

Luxembourg SOPARFI Holding & Finance Company. Its corporate purpose is limited to the Holding of Participations and related activities. The key benefits of a SOPARFI are the participation exemption on dividends, capital gains and wealth tax.

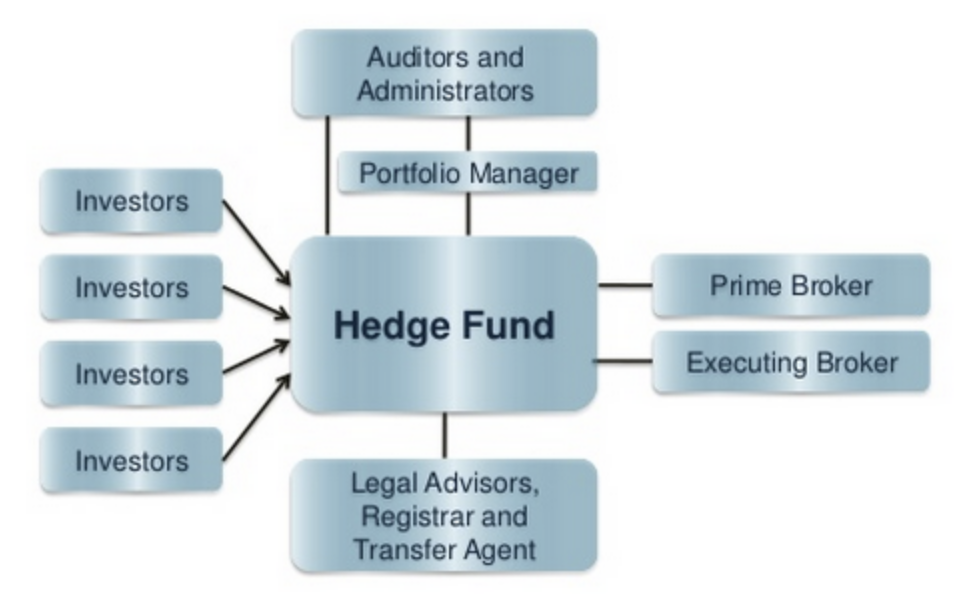

Investment Funds

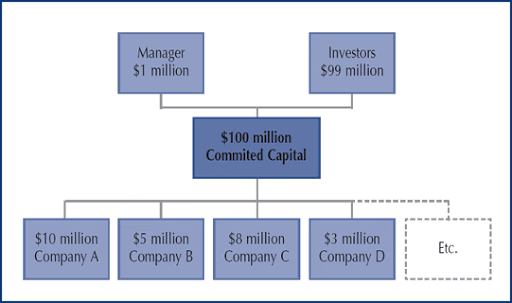

BVI Hedge Funds

Typical BVI Hedge Fund Structure

Panama

Mutual Investment Funds

Twenty and Fifty Investors Funds

PIF 20 - PIF 50

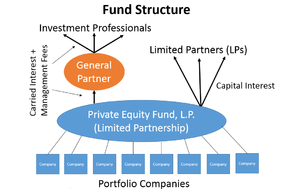

UK Private Fund

Limited Partnership

The UK Collective Investment Scheme

FINTECH – ATIVAR

Modern business banking

Fully managed solution!

This new business banking system allows you changing white-label

platform, utilising cutting edge cloud technology in banking and

payments and creating a compliant solution that has the potential to

offer real tangible selling points, in sectors that are often competing

for that extra competitive advantage.

FINTECH – ATIVAR

Regulation & Compliance

24/7 Software Monitoring

Live Chat – Telephone Support

Training

without dealing with licensing and compliance complexity.

FINTECH – ATIVAR

No in country presence required.

Hold balances on up to 26 currency accounts.

Over 2,000 integrations and counting.

FINTECH – ATIVAR

Offer financial capabilities

to compliment your businesses existing service!

FINTECH – ATIVAR

No more costly and time-consuming account opening processes.

No corporate presence required to collect payments locally.

all the way to live customers and beyond.

Licensing Services

Our Company Services

Services we DO and Services we DO NOT DO

Our company is EXCLUSIVELY engaged in assisting worldwide clients, either individuals or corporate entities, to get duly and properly registered and licensed with local Regulators and Financial Authorities to get respective official licenses to legally carry out their cryptocurrency business activities.

Atrium Legal Lab does not carry out any sort of cryptocurrency business trade or financial service!

Matter you would like to discuss with us

Our multi-lingual team of business advisors is happy to assist you with all upcoming questions and issues in relation to your company.

You may call or email us, and we will be happy to assist you in a fast and efficient manner.

You can also come visit us at one of our offices near you, to personally discuss all matters you need to clarify, before you take a decision.

Arrange an appointment and we will be happy to meet with you.

However, we strongly recommend you complete the form below, before calling us, since your initial questions, doubts, information and concerns, are most important to us, to properly assist you. Thank You!

The information and materials contained in this website do not constitute an offer, invitation, solicitation, advice or recommendation to buy the products and services offered and rendered by Atrium Legal Lab and shall be applied with prior consultation.

Atrium Legal Lab does not offer legal or tax advice without consultation with certified professionals with related appropriate skill and expertise.

The information contained in this website is for general guidance on matters of interest only and should not be considered as guidance for financial or tax decisions, or a substitute for specific professional consultation.

Atrium Legal Lab is not a bank, nor does it provide banking services. Atrium Legal Lab offers international company formation, corporate administration services, and bank/broker introductory services and account opening assistance.

This website is only used for promotional marketing purposes of Atrium Legal Lab and is not intended to portray that this is the site of a bank. All prospective clients should consult a properly qualified tax professional in their own country to determine their own tax implications prior to embarking on any strategy described in this website. Since laws in each country are different, constantly change and can be subject to different interpretations by courts of law, any information herein regarding tax minimization needs to be verified by such competent counsel. While we have made every effort to ensure that the information contained in this website is accurate and correct due to constant changes in laws, rules and regulations Atrium Legal Lab Ltd accepts no liability for any loss or damage arising directly or indirectly from action taken or not taken relying on the information contained in this website. In particular no warranty is given as to the completeness, accuracy, reliability of such information and as to whether it is at all times up to date.

Atrium Legal Lab accepts no liability for any loss or damage direct or indirectly arising from the application of any information contained in this website, including any loss, damage or expenses arising from, but not limited to, any defect, error, mistake, inaccuracy, reliability of this website, its contents or related services, or due to any unavailability of this Site or any part thereof of any contents or related services.

Due to our internal policies to prevent fraudulent activities or violations of our internal AML policies we are regretting that we do not provide consultations, email support, on-boarding activities and customer care to all OECD black listed countries and their citizens / entities.